when will capital gains tax increase in 2021

By Freddy H. The net long-term capital gain is the difference between long-term capital gains and long-term capital losses including any unused long-term capital loss from previous years.

Mutual Fund Taxation Fy 2021 22 Ay 2022 23 Capital Gain Tax Rates Basunivesh

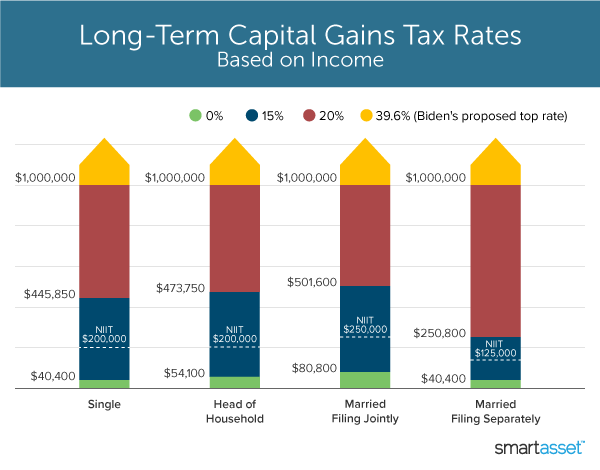

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20.

. The top rate would be 288. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said. Thats currently 37 but the president is also expected to call for an increase in the top rate for ordinary income to 396.

Capital Gains Tax Rate Update for 2021. In the United States the various LTCG tax rates are 0 15 and 20 based on the taxable income and corresponding tax bracket. The rate could be as high as 396 matching the top ordinary income tax rate before the Tax Cuts and Jobs Act TCJA.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The proposal would increase the maximum stated capital gain rate from 20 to 25. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

Thats 50 more funds predicted to make large taxable distributions of more than 10. As you can see the rate is based on your taxable income and how you file your income taxes. The 238 rate may go to 434 for some.

Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021. But because the higher tax rate as proposed would only. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

The current tax preference for capital gains costs upwards of 15 billion annually. The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million. Its time to increase taxes on capital gains.

Long-term capital losses can offset long. The announcement of the plan formally kicked off the legislative. Remember if you have short-term capital gains they are taxed at the ordinary income tax rates.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. Theyre subject to three rates. Could capital gains taxes increase in 2021.

That rate hike amounts to. The effective date for this increase would be September 13 2021. Capital gains tax rates on most assets held for a year or less correspond to.

Here are the 2021 long-term capital gains tax rates. Here are 10 things to know. Posted on January 7 2021 by Michael Smart.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. The current capital gain tax rate for wealthy investors is 20. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently.

Capital gains arent taxed at just one rate. In 2021 and 2022 the capital gains tax rates are. Those with less income dont pay any taxes.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers. Apr 23 2021 305 AM.

Single taxpayers with between roughly 40000 and 446000 of income pay 15 on their long-term capital gains or dividends in 2021. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased.

Short-term gains are taxed as ordinary income. For 2021 the federal capital gains rate is 0 if your taxable income is under around 80000 15 for taxable income from about 80000-500000 and 20 once you hit around 500000 3. Hundred dollar bills with the words Tax Hikes getty.

By Ken Berry JD. And CapGainsValet predicts 2021 will see more than double the historical average of funds making distributions of more than 10. On December 31 2026 the taxpayer will receive a 100000 10 step-up in basis so the 28 capital gains tax rate will be applied to.

0 15 and 20 based on your overall income level for the year. While it is unknown what the final legislation may contain the elimination of a rate increase on capital gains in the draft legislation is encouraging. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

But in 2020 with very good market performance and continued mutual fund outflows 2021 is expected to be much more significant. Once fully implemented this would mean an effective federal. 2 days agoA capital gains tax is a tax on the increase in the value of your investments over time.

Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. On April 28 2021 President Biden released the American Families Plan which included a proposal to increase the long-term capital gains tax rate for households with income exceeding 1 million to 396 from the current 20 tax rate.

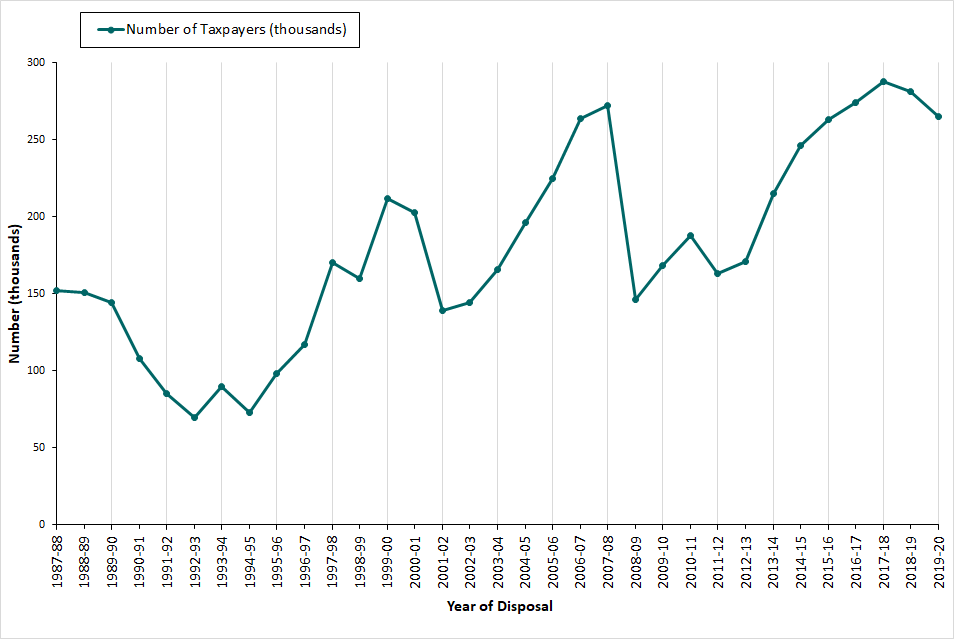

Capital Gains Tax Commentary Gov Uk

Mutual Funds Taxation Rules Fy 2020 21 Capital Gains Dividends

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Capital Gains Tax What Is It When Do You Pay It

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

What You Need To Know About Capital Gains Tax

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax Commentary Gov Uk

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

What S In Biden S Capital Gains Tax Plan Smartasset

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)